Shopee Xpress, through the SLoan for Sellers service by SeaMoney, offers an opportunity for Shopee sellers to access working capital loans. This provides sellers with greater financial capability to expand and grow their businesses. Here’s a quick guide on how to obtain a loan through Shopee Xpress:

What is SLoan for Sellers?

SLoan for Sellers by SeaMoney is a working capital loan service for Shopee sellers aimed at bolstering their short-term working capital. Eligible Shopee sellers can secure loans of up to RM300,000 with an interest rate as low as 18% per annum.

Is SLoan for Sellers a Licensed Product in Malaysia?

SLoan for Sellers is a digital financing solution offered by SeaMoney Capital Malaysia Sdn Bhd. The Malaysian company has been granted a money lending license (No. WL7728/14/01-2/240225) under the Moneylenders Act 1951 by the Ministry of Local Government Development (KPKT).

What are the Benefits of SLoan for Sellers?

The key benefits of SLoan for Sellers include:

- Easy application process and fast loan approval within 24 hours

- Competitive interest rate of 1.5% per month

- Fast and secure multi-channel and automatic repayment features

- Flexible loan tenures tailored to your needs

Check Your Shopee Status HERE

How to Activate SLoan for Sellers in the Shopee Application?

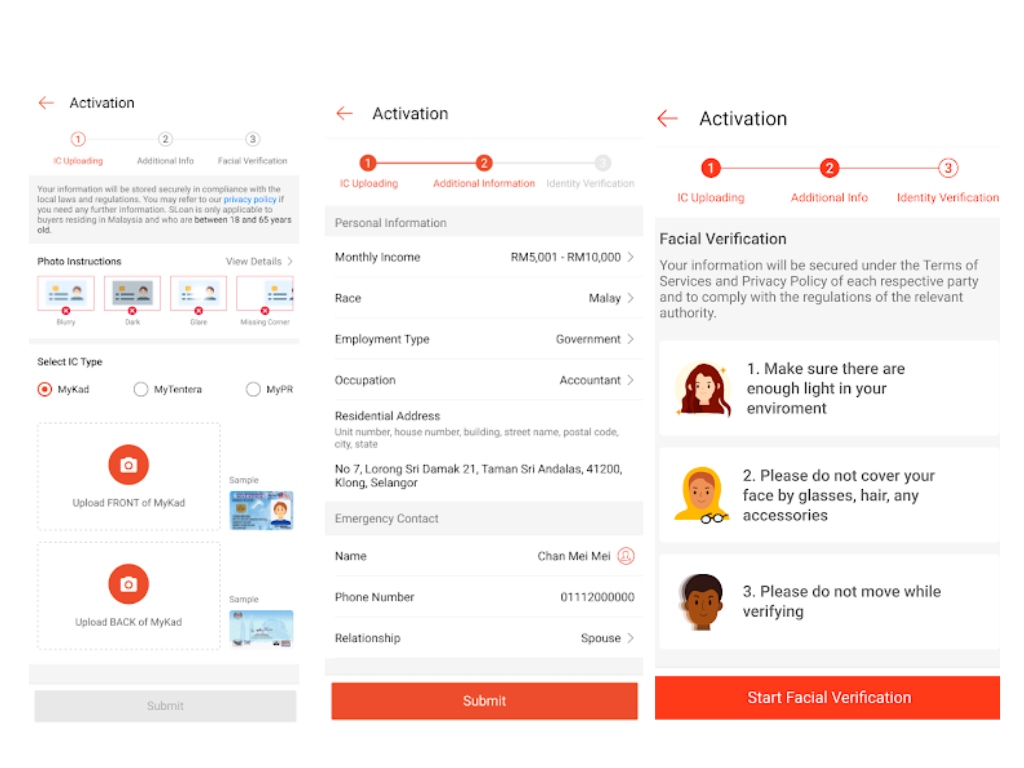

Follow these steps to activate SLoan for Sellers:

- Open the Shopee app and navigate to “Me” > “My Shop”

- Select SLoan for Sellers* and click “Activate Now”

- Complete the 3-step verification process to proceed with the loan application:

- Upload both sides of your Identification Card (MyKad / MyTentera / MyPR)

- Fill in the required additional information

- Perform facial verification

How to Get SLoan on Shopee Xpress

- Access Shopee Seller Center: Open the Shopee app or visit the Shopee website. Go to the “Me” tab and select “My Shop” from the menu. Within the “My Shop” section, choose the “Finance” option. Alternatively, access the Shopee Seller Center through the homepage by scrolling down to the “See More” section and selecting “Finance”.

- Initiate the SLoan Application: Upon accessing the SLoan application form, fill out a straightforward questionnaire gathering essential information to assess your loan eligibility. Provide the required information and proof of identity.

- Review Your Application: After submitting your application, it will undergo a review process. Upon completion of the review, you will receive a notification regarding the status of your application.

- Receive Approval and Access Your Loan: If your application is approved, you can access the approved loan directly through your Shopee Seller Center account.

SLoan offers flexible loan terms with options of 3, 6, or 12 months, allowing you to customize your loan repayments to fit your specific cash flow patterns. The application process is streamlined and requires minimal documentation, including a government ID as mandatory. SLoan also boasts a fast approval and withdrawal process, ensuring that you can access your loans within minutes of approval.